Foggy Weather Accidents: How Insurers Determine Fault and Who Pays

The Treacherous Nature of Fog: Understanding the Unique Risks

Driving through a dense, disorienting fog is an experience that unnerves even the most seasoned drivers. The world shrinks to just a few feet ahead of your vehicle, and familiar roads become treacherous and unpredictable. When a car accident occurs in these conditions, the immediate aftermath is often compounded by confusion. With visibility near zero, determining who is at fault is far from straightforward. This complexity extends directly to the insurance claim process, where investigators must peel back the layers of uncertainty to assign liability and determine who pays for the damages.

This article provides a comprehensive guide to understanding how foggy weather accidents are handled, from the initial investigation to the final insurance payout. We will explore the unique risks of driving in fog, delve into the meticulous process insurers use to determine fault, and clarify how different insurance policies respond when a collision occurs in bad weather.

The Treacherous Nature of Fog: Understanding the Unique Risks

Fog is not just rain or snow; it presents a unique set of challenges that directly impact a driver’s ability to operate their vehicle safely. Unlike other forms of bad weather, fog directly attacks a driver's most critical sense: sight. Understanding these specific risks is the first step in appreciating why determining liability in a fog-related accident is so complex.

Why Fog is Uniquely Dangerous for Drivers

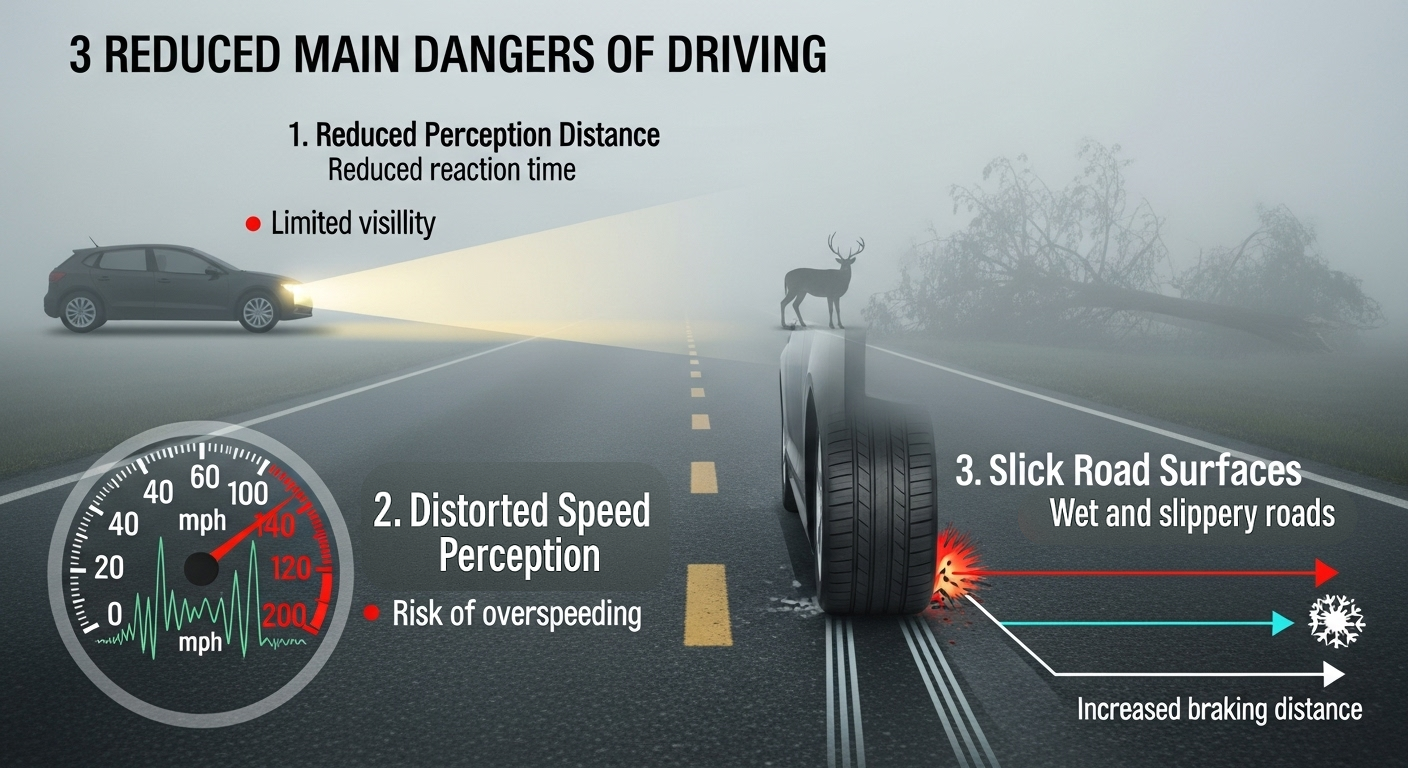

Fog creates unique driving hazards: limited visibility shortens reaction time, distorted speed perception leads to unintentional speeding, and slick roads increase braking distance.

The primary danger of fog is its profound reduction of visibility. This limitation has several critical effects on driving. First, it drastically shortens a driver's perception distance—the space they have to see, identify, and react to a hazard. A vehicle, pedestrian, or stopped car can appear with almost no warning.

Second, fog distorts the perception of speed.

With fewer visual cues from the surrounding environment, it becomes difficult for a driver to accurately gauge how fast their vehicle is moving, often leading to unintentional speeding. Finally, the moisture in fog can make road surfaces slick, increasing the braking distance required to come to a safe stop once a hazard is finally identified.

Common Types of Fog-Related Accidents

The dangerous conditions created by fog lead to specific types of collisions. Rear-end accidents are incredibly common, as drivers are unable to see stopped or slowing traffic ahead until it is too late. The reduced visibility and shortened reaction times create a perfect storm for this type of collision. Another frequent and particularly dangerous event is the multi-vehicle pile-up. A single initial accident can trigger a chain reaction as subsequent drivers, unable to see the obstruction ahead, collide with the stopped vehicles, creating a catastrophic scene that makes a subsequent investigation incredibly difficult.

How Insurers Investigate Foggy Weather Accidents

When an insurance company receives a claim for a car accident that occurred in fog, it triggers a detailed investigation process. The adjuster cannot simply blame the weather; their job is to determine if driver negligence contributed to the collision despite the poor visibility. This investigation is multi-faceted, relying on a combination of official reports, physical evidence, and advanced data analysis.

The Initial Investigation by Law Enforcement

The foundation of any insurance investigation is the official police report. Law enforcement officers responding to the scene document critical details, including the positions of the vehicles, statements from each driver and any witnesses, and an initial assessment of the weather conditions. They may note the estimated visibility distance and any contributing factors they observed, such as a driver admitting to speeding or being on their phone. While not the final word on liability, this report provides an unbiased, third-party account that is invaluable to the insurance company.

Advanced Investigative Techniques

Insurers go far beyond the police report. The claims adjuster will conduct their own analysis. They will scrutinize photographs of the vehicle damage, which can help reconstruct the accident by showing the points of impact and the severity of the collision. Statements from all involved parties are re-examined for inconsistencies. Crucially, in the modern era, insurers increasingly rely on technology. They may request data from a vehicle’s event data recorder (EDR), or "black box," which can show the vehicle's speed, braking inputs, and other metrics just before the impact. Telematics data from usage-based insurance programs or dashcam footage can also provide an objective, second-by-second account of what happened.

Assessing the Role of Weather Conditions

A key part of the investigation is to officially document the weather conditions at the precise time and location of the accident. The insurance company won't just take the driver's word for it. They will pull certified meteorological reports and access data from nearby weather stations to confirm the density of the fog and the actual visibility range. This information is critical because it establishes the "baseline" condition. The central question of the investigation then becomes: did the drivers involved adjust their driving appropriately for these documented weather conditions?

Determining Fault and Negligence in Foggy Conditions

In the world of insurance and law, an accident in bad weather is rarely considered an "act of God." Instead, the focus shifts to the legal concept of negligence. Every driver has a duty to operate their vehicle in a safe and prudent manner, and this duty is heightened when conditions are hazardous.

The Standard of Care for Drivers in Fog

The law doesn't expect drivers to be perfect, but it does expect them to be reasonable. The "reasonable person standard" is a legal principle that asks what a reasonably prudent person would have done in the same situation. In foggy conditions, a reasonable driver is expected to significantly adjust their behavior. This includes reducing speed to a level appropriate for the limited visibility (which is often far below the posted speed limit), increasing following distance to allow for longer reaction times, and using appropriate lights to be seen by others. Failure to take these precautions can be considered a breach of the standard of care.

Factors That Indicate "Driver Negligence"

During an investigation, an insurance company looks for specific actions—or inactions—that point to driver negligence. The most common factor is speeding for the conditions

Driving at the posted speed limit in dense fog is almost always considered negligent. Other indicators include:

Failure to use headlights: Using low beams (not high beams, which reflect off the fog) is essential for visibility.

Following too closely: Tailgating in fog eliminates any margin for error.

Distracted driving: Any activity that takes a driver's attention away from the road, such as using a phone, is magnified as a negligent act in low visibility.

Commercial Vehicle Considerations: If the driver was operating a commercial vehicle, their employer could share liability if it's found they had inadequate training policies for driving in adverse weather.

Understanding "Comparative Negligence"

It is rare for one driver to be 100% at fault in a fog-related accident, especially in multi-vehicle pile-ups.

This is where the principle of comparative negligence comes into play.

This legal doctrine allows fault to be shared among multiple drivers.

For example, one driver may be found 70% at fault for speeding, while another is found 30% at fault for following too closely.

The insurance company's investigation will aim to assign these percentages of liability. The final financial responsibility for the damages is then divided according to this allocation of fault.

Who Pays? Navigating the Insurance Claims Process

Once the investigation is complete and liability has been assigned, the focus shifts to financial compensation. The question of "who pays" depends on the fault determination and the types of insurance coverage each driver has.

The Role of Your "Insurance Policy"

Your auto insurance policy is a contract that contains several different types of coverage. The most relevant ones in a fog-related accident are liability coverage and collision coverage.

Liability Coverage:This pays for damages you cause to another person's vehicle or property. If you are found to be at fault, your liability insurance will pay for the other driver's repairs, up to your policy limits

Collision Coverage: This is optional coverage that pays to repair your own vehicle after an accident, regardless of who is at fault. If you are not at fault, your insurer may pay for your repairs under your collision coverage and then seek reimbursement from the at-fault driver's insurance company.

Initiating the "Insurance Claim"

The process begins the moment you report the accident to your insurance company. You should do this as soon as possible, even if you believe you are not at fault. You will need to provide basic information about the accident, including the time, location, weather conditions, and the other driver's information. Your insurer will assign a claims adjuster to your case who will guide you through the next steps, including getting a damage estimate for your vehicle.

The "Claims Process" and Payouts

After you file the claim, the adjuster conducts the investigation to determine liability. If the other driver is deemed 100% at fault, their liability insurance should cover all your damages. If you are found partially at fault under comparative negligence, their insurer will only pay for the portion of damages they are responsible for. For example, if you have $10,000 in damages but are found 20% at fault, the other driver's policy will only pay $8,000. In this scenario, you would rely on your own collision coverage to pay for the remaining $2,000, minus your deductible.

The Importance of Legal Counsel

For minor accidents, navigating the insurance claim process is often manageable on your own. However, in cases involving serious injuries or complex liability disputes, such as a multi-vehicle pile-up in fog, seeking legal counsel can be crucial. An experienced attorney can help ensure the investigation is fair, advocate on your behalf with the insurance company, and help you navigate the complexities of comparative negligence to ensure you receive fair compensation for your damages.

Preventing Foggy Weather Accidents: Driver Best Practices

The best way to deal with a foggy weather accident claim is to avoid the accident altogether. Safe driving in fog requires a conscious shift in mindset and a proactive approach to safety.

Essential Driving Techniques for Fog

When you encounter fog, immediately adjust your driving.

Slow down significantly to a speed that allows you to stop within the distance you can see ahead.

Use your low-beam headlights and fog lights if your vehicle has them; high beams will reflect off the fog droplets and worsen your visibility.

Increase your following distance to at least five seconds behind the vehicle in front of you. Minimize all distractions—turn off the radio, put your phone away, and focus completely on the task of driving.

Vehicle Preparation and Safety Measures

Before you find yourself in bad weather, ensure your vehicle is prepared. Regularly check that all your lights—headlights, taillights, and fog lights—are clean and working correctly. Make sure your windshield wipers are in good condition and your washer fluid reservoir is full. A clean windshield is essential for maximizing what little visibility you have. Being prepared can make a critical difference when conditions unexpectedly deteriorate.

Conclusion: Driving Safely in the Face of Fog

A car accident in the fog is a uniquely challenging event, creating a chaotic scene that makes determining fault a complex puzzle for any insurance company. The core of the issue lies not with the weather itself, but with how a driver responds to it. Through a meticulous investigation process, insurers analyze every piece of evidence to distinguish between an unavoidable collision and one caused by driver negligence.

Recap of Key Takeaways

The key takeaway is that a driver's legal duty of care is elevated in adverse weather. Failing to reduce speed, increase following distance, and use proper lights can lead to a finding of negligence, making you liable for damages. Understanding that insurance companies use police reports, physical evidence, and technology to reconstruct the accident helps clarify how fault is assigned. Finally, knowing how your own liability and collision coverages work is essential for navigating the claims process and ensuring your damages are covered.

Prioritizing Safety and Preparedness

Ultimately, the best strategy is prevention. By adopting defensive driving techniques and ensuring your vehicle is properly maintained, you significantly reduce your risk of being involved in a fog-related collision. Driving with caution and an acute awareness of the limited visibility is not just a safety tip—it is your primary defense against liability in the event of an accident. In the disorienting blanket of fog, caution is your clearest guide.