Deer Collisions: Essential Insurance Coverage Drivers Need to Know Now.

The gentle roll of Tennessee's hills and the beauty of its winding country roads are a core part of the state's charm. But as the sun dips below the horizon, these same roads present a significant risk for drivers: deer. A sudden flash of white tail and the sickening thud of impact can turn a peaceful drive into a costly and dangerous ordeal. Statewide in Tennessee during 2023, there were 7,412 animal related crashes, the majority of which involved deer, making this a pervasive issue for residents.

For Tennessee drivers, the question isn't just about avoiding a collision; it's about being financially prepared for one. Understanding the nuances of your auto insurance policy is the single most important step you can take to protect yourself from the significant financial fallout of a deer-vehicle collision. The right coverage can mean the difference between a manageable inconvenience and a devastating out-of-pocket expense.

The Unsettling Reality of Deer-Vehicle Collisions in Tennessee

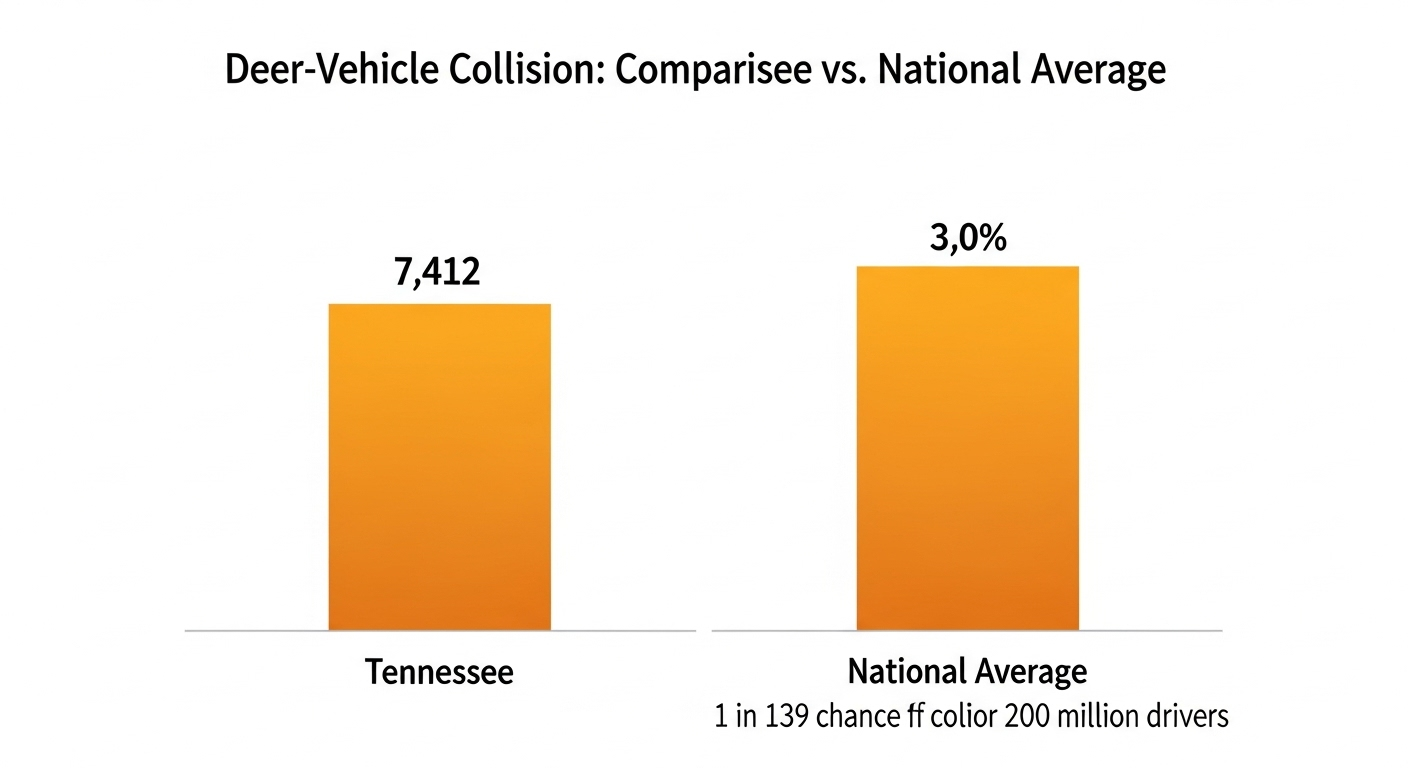

This chart compares the number of deer-vehicle collisions in Tennessee in 2023 to the national average probability of such a collision.

The statistics paint a sobering picture. The risk is not a distant possibility but a frequent reality on Tennessee roads. Nationally, State Farm estimates that from July 1, 2024, to June 30, 2025, there were 1.7 million auto insurance claims resulting from animal collisions. This widespread issue has a significant local impact, making it crucial for drivers to recognize the consistent threat posed by wildlife.

Why Tennessee Drivers Need to Be Prepared

Beyond the statistics, the tangible risk is ever-present. The Tennessee Highway Patrol has already reported over 4,000 crashes involving deer in 2023, which tragically resulted in three fatalities and over 300 injuries. These numbers highlight that deer collisions are not just about fender benders; they carry the potential for serious physical harm. With a national estimate giving U.S. drivers a 1 in 139 chance of being involved in an animal collision over a one-year period, preparedness through proper car insurance is not optional—it's essential.

What This Guide Will Cover: Your Insurance Roadmap

This guide will serve as your comprehensive roadmap to navigating the insurance landscape after a deer collision in Tennessee. We will demystify the types of coverage that protect you, explain how deductibles work, detail the steps to take immediately following an incident, and clarify your reporting obligations. By the end, you will have the knowledge to ensure your insurance policy is a reliable shield against the unpredictable nature of Tennessee's roadways.

Understanding Deer Collisions on Tennessee Roadways

Effective preparation begins with understanding the enemy. Deer behavior is predictable to an extent, and knowing their patterns can significantly reduce your risk of a collision. Factors like time of day, season, and location all play a crucial role in the likelihood of encountering deer on the road.

Peak Times for Deer Accidents: Dawn and Dusk in Tennessee

Deer are crepuscular, meaning they are most active during the twilight hours of dawn and dusk. These are precisely the times when driver visibility is naturally reduced, creating a perfect storm for accidents. As daylight fades or just begins to break, drivers must exercise heightened caution, scanning the roadsides and reducing speed, particularly in wooded areas.

Identifying Deer Season and Rutting Season Risks

The autumn months, from October through December, mark the peak of deer-related incidents. This period coincides with the deer mating season, known as the "rut." During the rut, deer, especially bucks, are more active, less cautious, and far more likely to dart into traffic unexpectedly. This seasonal spike demands an elevated level of driver awareness.

Common Deer Behavior and the "Pack Rule"

A common mistake drivers make is assuming a single deer is the only threat. Deer often travel in groups. If you see one deer successfully cross the road, slow down and expect others to follow. Their instinct is to follow their leader, often without regard for oncoming traffic. The sight of one deer should be an immediate signal to brake safely and anticipate more.

High-Risk Areas and Roadways in Tennessee (General Observation)

While a deer can appear anywhere, certain areas pose a higher risk. Rural and two-lane roads bordered by forests, fields, or creeks are prime habitats for deer. In Tennessee, deer crashes are three times more likely to involve a fatality or serious injury in rural areas compared to urban locations. Posted deer-crossing signs are not decorative; they are placed in areas with known high levels of deer activity and should be heeded.

Your Auto Insurance Policy: The Core of Deer Collision Coverage

When a deer collision occurs, your first thought after ensuring everyone is safe is likely about your vehicle. The damage can be extensive, and the cost of repairs can be staggering. This is where your auto insurance policy becomes your most critical financial tool.

Comprehensive Coverage: Your Primary Defense Against Animal Strikes

The single most important coverage for a deer-related incident is Comprehensive coverage. Often misunderstood, comprehensive insurance is designed to cover damage to your vehicle from non-collision events. This includes theft, vandalism, falling objects, fire, and, crucially, contact with an animal. Without this specific coverage, you will likely be paying for all repairs out of your own pocket.

What Comprehensive Insurance Covers for Deer Accidents

If you have comprehensive coverage, your insurance company will pay for the repairs needed to restore your vehicle after a deer strike, minus your deductible. This includes everything from a smashed grill and broken headlights to more severe body damage and deployed airbags. It covers the direct impact with the deer itself.

Differentiating Comprehensive vs. Collision Coverage

This is a critical distinction. Collision coverage pays for damage to your vehicle when it collides with another object (like another car or a stationary pole). Comprehensive covers "other than collision" events. Hitting a deer is classified as an "other than collision" event, falling squarely under the comprehensive portion of your auto insurance. If you only carry liability and collision coverage, you are not protected against deer damage.

When Collision Coverage Might Apply (Indirect Deer-Related Damage)

There is a key scenario where collision coverage would apply. If you swerve to avoid hitting a deer and subsequently crash into a guardrail, a tree, or another vehicle, the resulting damage would be covered by your collision insurance. This is a crucial nuance: the claim shifts from a comprehensive claim (hitting the deer) to a collision claim (hitting an object while avoiding the deer).

The Deductible Dilemma: Your Out-of-Pocket Cost

Even with the right coverage, you will have some out-of-pocket expenses. Understanding your deductible is key to managing the financial side of a deer collision claim and making informed decisions about your insurance policy before you ever need it.

How Your Auto Deductible Works for Deer Collision Claims

A deductible is the amount of money you are responsible for paying before your insurance company begins to cover the costs. If your vehicle sustains $4,000 in damage from a deer collision and your comprehensive deductible is $500, you will pay the first $500, and your insurer will cover the remaining $3,500.

Understanding Different Deductible Amounts and Their Impact

Deductibles typically range from $250 to $1,000 or more. A higher deductible generally results in a lower premium for your auto insurance policy, while a lower deductible means a higher premium. You must choose a deductible amount that you can comfortably afford to pay on short notice in the event of a claim.

Weighing the Cost of a Deductible Against Minor Vehicle Damage

Sometimes, the damage from a deer collision may be minor. If a repair estimate is only slightly more than your deductible, you might consider paying for it out-of-pocket. Filing a claim could potentially impact your future insurance rates, so for minor damage, avoiding a claim might be a better long-term financial decision.

Deductibles Across Various Auto Policy Coverages

It's important to remember that you may have different deductibles for different coverages. Your comprehensive deductible (used for the deer claim) may be different from your collision deductible. Always review your insurance policy declarations page to know exactly what your out-of-pocket costs will be for each type of claim.

Beyond Vehicle Damage: Injuries, Totaled Vehicles, and Other Costs

A significant deer collision can result in more than just cosmetic damage. The impact can cause serious injuries to occupants, deem the vehicle a total loss, and incur additional costs like towing and rental cars. Having the right supplementary coverages is vital.

Medical Payments Coverage (MedPay) for Occupant Injuries

Medical Payments Coverage, or MedPay, is an optional coverage in Tennessee that helps pay for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault. After a deer collision, this coverage can immediately assist with health insurance deductibles, co-pays, and other medical bills.

The Potential for Personal Injury Protection (PIP) in Other States (and Tennessee's lack thereof in standard policies)

While some states have mandatory Personal Injury Protection (PIP) coverage, which is more extensive than MedPay, Tennessee is not one of them. Drivers in Tennessee do not have PIP as a standard part of their auto insurance. This makes optional coverages like MedPay even more important for protecting yourself and your passengers from medical costs.

When a Deer Collision Can Lead to a Totaled Vehicle

The average adult deer can weigh over 150 pounds, and a high-speed impact can cause catastrophic damage. In Tennessee, the financial impact is significant; one major insurer handled over 10,000 deer claims in 2023, paying nearly $70 million for repairs and total losses, with an average cost of $6,500.

If the cost to repair your vehicle exceeds a certain percentage of its actual cash value, your insurance company will declare it a total loss.

Additional Costs: Towing and Rental Car Coverage (Roadside Assistance)

If your vehicle is not drivable after hitting a deer, you’ll need it towed. If repairs take several days or weeks, you may need a rental car. Towing and Rental Reimbursement are inexpensive, optional coverages that can be added to your insurance policy. Without them, these unexpected costs will come directly out of your wallet.

What to Do Immediately After a Deer Collision in Tennessee

In the chaotic moments after a collision, knowing what steps to take can protect your safety and strengthen your future insurance claim. Acting calmly and methodically is key.

Prioritizing Safety: Check for Injuries and Move to a Safe Location

Your first priority is safety. Check yourself and your passengers for injuries. If possible, move your vehicle to the shoulder of the road, away from traffic. Turn on your hazard lights to alert other drivers. Do not approach the injured deer; it could be frightened and dangerous.

Reporting Requirements: When a Police Report is Needed in Tennessee

In Tennessee, you are legally required to report an accident to the police if it results in injury, death, or property damage that appears to be $50 or more. Given the cost of modern vehicle repairs, virtually any collision with a deer will exceed this threshold, making a police report a legal necessity.

Understanding Tenn. Code Ann. § 55-10-106 for Accident Reporting

This specific Tennessee statute outlines the driver's duty to report accidents. Complying with this law is not only a legal obligation but also a crucial step for your insurance claim. A police report serves as official, third-party documentation of the incident, which is invaluable when dealing with your insurance company.

Documenting the Scene: Photos, Witness Information, and Vehicle Damage

While waiting for the police, document everything. Use your phone to take pictures of the scene, the damage to your vehicle (including close-ups and wider shots), the deer (if safe to do so), and any relevant road signs. If there are any witnesses, get their names and contact information. This evidence helps validate your claim that the damage was caused by an animal.

Conclusion

Navigating the roads of Tennessee requires an awareness of the persistent risk of deer-vehicle collisions. The unpredictable nature of these encounters makes financial preparedness not a luxury, but a necessity. The core of this protection lies within your auto insurance policy, specifically with Comprehensive coverage, which is your primary defense against the high costs of repairs or a total loss. Understanding the distinction between comprehensive and collision, the function of your deductible, and the value of supplemental coverages like MedPay and rental reimbursement empowers you to build a policy that truly protects you.

The key takeaways are clear: know the high-risk times and locations, never assume one deer is the only one, and most importantly, understand the insurance coverage you have before you need it. If a collision does occur, prioritize safety, contact the police to create an official record, and document the scene thoroughly. This proactive approach will streamline the claim process and mitigate financial stress. Your next step should be a simple one: pull out your current auto insurance policy, review your coverages, and contact your insurance agent to fill any gaps. Being prepared is your best defense against the unexpected dangers of the road.