Navigating Car Insurance: 6 Essential Coverage Options

Imagine cruising down the open road, feeling the wind in your hair, and experiencing the sense of freedom that driving offers. Amidst this liberating experience, the uncertainty and risks of car ownership highlight the importance of having the right car insurance. Car insurance is not just a legal obligation; it is a critical safety net that protects drivers from potentially overwhelming costs associated with accidents, theft, and other unforeseen events.

Navigating the intricacies of car insurance can be overwhelming, given the wide range of coverage options available today. From the fundamental protection of liability coverage to the reassurance provided by uninsured motorist and comprehensive plans, each choice plays a crucial role in achieving well-rounded coverage. Understanding these coverages is vital, not only for your safety but also to responsibly safeguard others on the road.

In this article, we explore six key car insurance coverage options every driver should consider. We will examine how factors like your vehicle's value and state requirements can influence your policy choices, helping you design a personalized insurance plan tailored to meet your specific needs.

Understanding Liability Coverage: Protecting Others

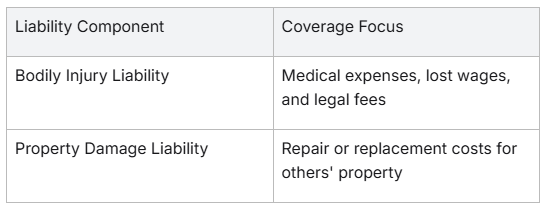

Auto liability coverage is a fundamental necessity for drivers in most states, ensuring protection for others when you're at fault in an accident. This essential part of car insurance is divided into two primary components:

Bodily Injury Liability : Covers medical expenses for other drivers and passengers affected by the accident.

Property Damage Liability : Takes care of damages to other vehicles or property.

It's important to note that liability insurance does not cover repairs to your own car; it solely addresses claims made by other parties involved. Having proof of this coverage is typically mandatory to legally operate your vehicle on public roads.

Here's a quick overview:

Auto liability coverage is crucial as it covers medical bills, property damages, and other losses incurred by the other party. This suite of protections ensures peace of mind, knowing potential financial burdens from accidental harm to others are managed.

Uninsured/Underinsured Motorist Coverage: Guarding Against the Unprepared

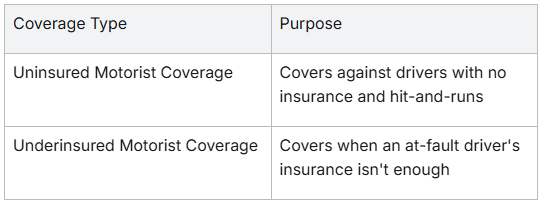

Uninsured motorist coverage is a vital part of car insurance, offering protection when you're struck by a driver who lacks insurance or in hit-and-run situations. This type of coverage helps cover damages and medical expenses, ensuring you're not left shouldering the financial burden.

Underinsured motorist coverage, on the other hand, steps in when the at-fault driver's liability limits fall short of covering the full extent of your damages and injuries. It provides a safety net by addressing the gap between their coverage and your actual costs.

In some states, uninsured or underinsured motorist coverage is optional but highly recommended. It offers peace of mind, knowing both medical bills and vehicle damage are covered in these unfortunate incidents.

A key benefit of this coverage is its comprehensive protection not only for the policyholder but also for family members and designated drivers. It extends a protective shield against the risks posed by underinsured or uninsured motorists.

Here's a quick breakdown:

Choosing the right coverage can protect you from unexpected and costly events on the road.

Collision Coverage: Safeguarding Your Vehicle

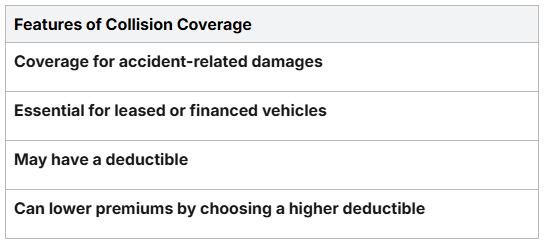

Collision coverage is a critical component of auto insurance that reimburses you for damages to your vehicle caused by a crash with another car, an object, or if your vehicle overturns. This type of coverage is essential if you have a newer car, are leasing a vehicle, or have an outstanding car loan. While collision coverage is sometimes packaged with comprehensive coverage, it specifically addresses damages from accidents.

Although typically optional, your lender or leaseholder may require you to have collision coverage to protect their investment. For those looking to manage the cost, opting for a higher deductible can lower your premiums, making it a more budget-friendly choice.

Here’s a quick look at what collision coverage involves:

Understanding the specifics and benefits of collision coverage can help ensure that your vehicle remains safeguarded against unexpected accidents. Consider discussing options with your insurance agent to tailor the coverage to meet your needs.

Comprehensive Coverage: Beyond Collisions

Comprehensive coverage offers extensive protection for non-collision incidents, safeguarding your vehicle against unexpected events. This type of auto insurance is crucial for ensuring peace of mind, as it covers scenarios such as theft, weather damage, vandalism, and animal collisions. Lenders often require comprehensive coverage if you are leasing or financing a vehicle, making it an essential component of your car insurance coverage.

Here's a quick breakdown of what comprehensive coverage includes:

Theft : Protects against vehicle theft or damage incurred during a theft attempt.

Weather Damage : Covers damages from natural disasters like floods, hurricanes, or earthquakes.

Vandalism : Offers protection against intentional damage to your vehicle.

Animal Collisions : Covers damages caused by hitting animals like deer.

Comprehensive coverage requires paying a deductible, which is the amount you pay out of pocket before your insurance company covers the rest. Despite this cost, comprehensive insurance can be a wise investment, especially for those looking to protect their vehicles' actual cash value regardless of its current worth. By investing in this type of coverage, car owners can rest easy knowing they're protected from life's unpredictable occurrences.

Medical Payments: Covering Medical Costs

Medical Payments Coverage, commonly known as MedPay, is a integral part of auto insurance that covers medical expenses for the policyholder and their passengers after an accident, regardless of who is at fault. This optional coverage is available in most states and provides financial protection against various medical-related expenses.

Key Features of MedPay:

Hospital and Doctor Fees: Covers costs incurred from hospital stays and doctor consultations.

Treatment Costs and Medications: Assists with payments for necessary medical treatments and prescription medications.

Ambulance Fees: Includes coverage for transportation costs to the hospital via ambulance after an accident.

Pedestrian Accidents: Offers protection for policyholders if injured while walking as a pedestrian.

MedPay can also help cover medical bills, funeral expenses, and health insurance deductibles, providing comprehensive financial support during challenging times. Understanding this coverage allows policyholders to make informed decisions regarding their auto insurance needs, ensuring peace of mind on the road.

Medical Payments Coverage: Additional Medical Support

Medical Payments Coverage, commonly referred to as MedPay, offers crucial financial protection by covering medical expenses for you and your passengers after a car accident, regardless of fault. This optional auto insurance coverage extends to a wide range of medical-related costs, such as hospital bills, doctor fees, treatment expenses, medications, and even ambulance fees.

A key benefit of MedPay is its flexibility; it provides coverage even if you're a pedestrian hit by a vehicle. Additionally, it covers funeral expenses and health insurance deductibles, offering broad support during challenging times. While it focuses on medical costs, it does not extend to property damage.

Here's a quick overview of what MedPay covers:

Medical and hospital bills

Ambulance and emergency services

Doctor and treatment fees

Medications

Funeral expenses

Health insurance deductibles

MedPay serves as a valuable safety net, enhancing the protection offered by your auto insurance policy and ensuring peace of mind in the aftermath of an accident.

Assessing Your Vehicle's Value: Tailoring Your Coverage

When choosing auto insurance, assessing your vehicle's value is crucial for customizing coverage.

Here are six types of coverage to consider:

Collision Coverage : This covers repair costs after an accident, up to your car's actual cash value minus the deductible. It's a necessity for protecting your investment.

Comprehensive Coverage : Protects against non-collision incidents like theft or natural disasters.

Gap Coverage : Ideal for leased or financed vehicles, it covers the difference between your car's actual cash value and the loan balance if totaled.

Uninsured/Underinsured Motorist Coverage : Shields you from damages when the at-fault driver lacks adequate insurance, including hit-and-runs.

New Car Replacement Insurance : Offers a new vehicle of similar make and model if severe damage occurs, differing from standard coverage by providing a replacement rather than market value.

Liability Coverage : Required in most states, this covers bodily injury and property damage caused to others in an accident.

Understanding these options allows tailoring of your auto policy to your financial needs and vehicle's worth, ensuring comprehensive protection.

Evaluating State Requirements: Compliance Matters

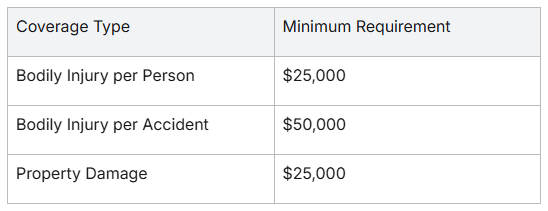

Understanding and meeting your state's minimum car insurance requirements is crucial for legal compliance and financial protection. Each state dictates specific requirements that motorists must adhere to, with liability insurance as a universal component. For instance, Tennessee, an at-fault state, mandates the following minimum liability coverage:

Meeting these requirements isn't just about compliance; it ensures that you're financially protected if you're deemed responsible for an accident. Without adequate liability insurance, you may face legal consequences and hefty out-of-pocket expenses when an accident occurs.

While the minimum coverage meets legal standards, it's wise to consider additional protection. Enhanced coverage options, such as comprehensive or collision coverage, provide a safety net beyond basic requirements, covering scenarios like theft, natural disasters, and other damages.

Adhering to state insurance laws is essential not only to avoid legal troubles but also to secure peace of mind knowing you're prepared for unexpected events on the road. Always consult with your insurance agent to explore options that best suit your needs.

Personal Driving Habits: Influencing Your Choices

Your personal driving habits significantly influence your car insurance choices. Safe driving can lead to lower premiums, thanks to Merit Rating Plans that reward incident-free records and penalize accidents. It's important to consider the value and age of your vehicle. Newer or high-value cars often necessitate comprehensive and collision coverage to ensure full protection.

If you're frequently on the road, broader options like Personal Injury Protection (PIP) or uninsured motorist coverage are advisable. These coverages offer additional protection against medical expenses and damages caused by drivers without adequate insurance.

Understanding the nuances of car insurance policies can be overwhelming. Consulting with an insurance agent can help you tailor a policy that suits your driving habits, needs, and budget. They can guide you in selecting the right coverage options, ensuring you are neither underinsured nor overpaying.

Here's a quick checklist to consider:

Review your driving record.

Assess your vehicle's value and age.

Determine your coverage needs based on driving frequency.

Consult with an insurance agent for personalized advice.

Tailoring your auto insurance policy around your personal driving habits ensures comprehensive protection and potential cost savings.

Conclusion: Crafting Your Ideal Policy

Crafting your ideal car insurance policy involves understanding the six primary types of auto insurance coverage. Each coverage type—such as liability coverage, collision coverage, and comprehensive insurance—carries its own costs and policy limits. It’s important to tailor these according to your needs and state requirements, as some coverages like bodily injury liability and property damage liability are often legally mandated.

Here is a quick list of essential coverages to consider:

Liability Coverage: Protects against bodily injury and property damage.

Collision Coverage: Covers damages from collisions.

Comprehensive Coverage: Non-collision events like theft and natural disasters.

Medical Payments Coverage: Medical expenses for you and your passengers.

Uninsured/Underinsured Motorist Coverage: Protects against drivers lacking sufficient insurance.

Personal Injury Protection (PIP): Covers medical expenses and sometimes lost wages.

Additionally, if you have a car loan or lease, comprehensive and collision coverage might be required by your lender. Consider supplementary options like Umbrella insurance for enhanced protection. Reviewing and understanding these options with an experienced insurance agent can ensure you craft a policy that balances coverage needs with cost efficiency.