From Permit to Policy: A Parents Guide to Insuring Teen Drivers in Tennessee

Excitement abounds when a teenager steps into the world of driving by obtaining their driver's permit. For parents, this milestone often comes with the intricate task of securing the appropriate insurance for their new driver. Navigating your teen's entrance into the driving scene in Tennessee involves understanding the state's Graduated Driver Licensing (GDL) laws and making well-informed decisions regarding insurance policies. Equipped with the right information, this transition can become smoother and more cost-efficient than expected.

Tennessee's GDL laws focus on fostering responsible driving habits by allowing teen drivers to gradually earn additional privileges as they gain more experience. When deciding whether to add your teen to an existing policy or to purchase a separate one, several factors such as cost, coverage, and convenience must be considered. Moreover, it's essential for parents to address the financial implications of not insuring a teen driver, while also considering how variables like gender and vehicle type can affect insurance rates.

This guide offers valuable insights designed to help you manage insurance costs effectively and ensure your teen driver is thoroughly protected. We cover practical strategies, from leveraging savings through good student discounts and safe driving programs to selecting budget-friendly, safe vehicles. By consulting with insurance providers, you can shape a coverage plan that strikes the perfect balance between safety and financial responsibility, enabling you to make confident and well-informed decisions.

Understanding Tennessee's Graduated Driver Licensing (GDL) Laws

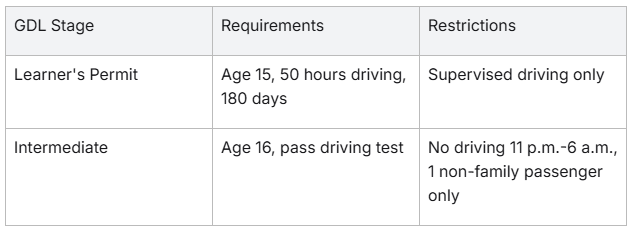

Understanding Tennessee's Graduated Driver Licensing (GDL) Laws is crucial for both teens and parents navigating the road to a full driver's license. In Tennessee, teens can embark on this journey by obtaining a Learner's Permit starting at age 15. During this initial stage, they are required to complete 50 hours of supervised driving, including 10 hours at night, and must hold the permit for at least 180 days.

Upon completing these requirements, teens can progress to the intermediate restricted license at age 16. This stage restricts driving between 11 p.m. and 6 a.m., and limits non-family passengers to one. Additionally, Tennessee's GDL laws advocate for safe driving by prohibiting the use of cell phones or electronic devices until teens hold a full driver's license.

Here's a quick look at the stages:

By understanding and adhering to these laws, teenagers can gradually build their experience and confidence behind the wheel, ensuring safer roads for everyone.

Deciding Between Adding a Teen to an Existing Policy or Securing an Individual Policy

When your teen starts driving, it's time to decide whether to add them to your auto insurance policy or help them secure their own. Typically, adding a teen to an existing policy is financially more viable, as securing an individual policy can be significantly costlier and complex. The general rule of thumb is to incorporate your teen into your policy if you want to lower expenses and tap into available discounts, like multi-vehicle and good student discounts. However, if your teen is older than 18, they may have the option to go solo. This choice involves weighing the financial implications and understanding the potential impact on your insurance coverage and premiums.

Pros and Cons of Adding a Teen to an Existing Policy

Adding a teen driver to your existing insurance policy often emerges as the more cost-effective option compared to an individual policy. It's crucial to promptly update your policy when your teen becomes a licensed driver and still lives at home, as insurers typically require this. Although you'll see a premium increase, usually between 130% to 140%, it's generally less severe than the hike you'd face with an individual policy for your teen. Additionally, your teen could benefit from discounts related to their academic performance or safe driving practices. On the downside, not notifying your insurer of a new teen driver in the household can lead to denied claims or coverage gaps. Therefore, keeping your insurance provider informed is critical for maintaining robust coverage and avoiding unwanted surprises.

Costs and Considerations for Individual Policies

Securing an individual car insurance policy for a teen can be a hefty investment, often costing two to three times more than simply adding them to a family policy. For instance, a 16-year-old male might face annual costs of around $7,541, compared to $6,757 for a female teen. This discrepancy stems from the higher perceived risk associated with male teen drivers, resulting in elevated premiums. An individual policy might encourage teens to take responsibility and could help them build a credit history if they handle payments independently. However, such a policy means missing out on family-related discounts, amplifying the financial burden. Furthermore, younger teens or those not yet emancipated may encounter challenges in securing an independent policy. Therefore, while individual policies come with certain benefits, they are often costly and less accessible for young drivers.

Financial Implications of Not Insuring a Teen Driver

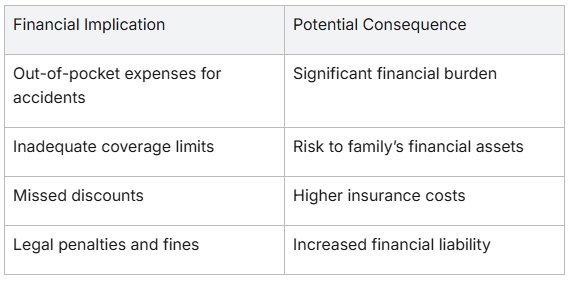

When adding a teenage driver to your auto insurance in Tennessee, the financial implications of not doing so can be significant. Uninsured teen drivers are considered high-risk, meaning any accident they are involved in could lead to substantial out-of-pocket expenses for damages. Moreover, existing insurance policies without teen driver considerations might lack adequate coverage limits, potentially exposing your family's financial assets. It might be necessary to raise liability coverage to ensure sufficient protection.

Not insuring a teen driver can also mean missing out on various discounts designed for young drivers, such as good student discounts or reduced rates for completing driver education courses. These can significantly lower the cost of adding a teen to your policy.

Additionally, uninsured teen drivers risk facing legal penalties or fines if found driving unsupervised without the mandatory coverage. The table below highlights potential financial implications:

Ultimately, adding a teen to your auto policy can be a strategic way to manage these financial risks while ensuring adequate protection and maximizing available discounts.

Factors Affecting Insurance Costs for Teen Drivers

When it comes to auto insurance, teen drivers often face higher costs due to their inexperience behind the wheel. This lack of experience makes them more prone to accidents, which in turn drives up insurance premiums. Generally, adding a teen driver to an existing policy can increase rates by a hefty margin, often estimated between 70% to 150%. However, there may be ways to mitigate these costs. Discounts are often available for teenage drivers who maintain good grades, with insurers offering good student discounts for students with a GPA of 3.0 or higher. Additionally, participating in defensive driving courses can reduce premiums. Insurance companies may classify teenage drivers as high-risk due to their possible propensity for risky behaviors, such as distracted driving. Therefore, selecting the right type of policy and leveraging discounts can significantly impact insurance expenses for this age group.

Gender Differences in Premiums

In the realm of auto insurance, gender plays a notable role in determining premiums for teen drivers. Male teenagers are statistically more involved in fatal crashes, leading insurers to charge higher premiums for them compared to their female peers. This is largely due to a perceived increase in risky driving behavior among young males, including a higher likelihood of speeding and driving under the influence. Thus, a 16-year-old male added to a parent's policy typically incurs higher costs than a female of the same age.

However, it's important to note that in some U.S. states, gender cannot legally influence car insurance rates. In these areas, pricing practices are more uniform across genders. Despite these exceptions, the general trend remains that male teen drivers bear higher insurance costs due to their increased accident risk, as reflected in statistical data widely used by insurance companies.

Vehicle Type and Its Impact on Insurance Rates

The choice of vehicle for a teen driver significantly impacts the cost of insurance. Opting for a family sedan, minivan, or small SUV often results in more favorable insurance rates as these vehicles are considered safer options. Conversely, insuring a sports car or high-performance vehicle can lead to substantially higher premiums due to the increased risk associated with their use.

Such features not only enhance protection during an accident but also provide peace of mind to parents of teenage drivers. Sharing a family vehicle rather than purchasing a new one for the teen can further contain insurance costs, as it avoids the steep premiums associated with insuring new or high-performance models.

While older vehicles might seem like a cost-effective option, they do not always offer the best insurance rates. Cars with updated safety features can sometimes offer price reductions on premiums. Therefore, selecting a vehicle with a strong safety record and modest power provides the dual benefit of lower insurance costs and enhanced safety for teen drivers.

Strategies to Reduce Insurance Costs for Teens

As a parent in Tennessee, adding a teenage driver to your auto policy can initially be daunting due to the potential increase in insurance costs. However, several strategies can help mitigate these hefty premiums. Implementing effective tactics, such as leveraging discounts and promoting safe driving behaviors, can significantly reduce expenses. These practices not only offer financial relief but also encourage responsible driving among teens, fostering long-term safe driving habits that benefit both parents and young drivers. Understanding these options can make the transition into driving less burdensome.

Utilizing Good Student Discounts

Taking advantage of good student discounts is a smart way to cut down on auto insurance expenses for families with teenage drivers. Insurance companies offer these discounts as an incentive for students excelling in academics, typically requiring a GPA of 3.0 or higher or a class ranking within the top 20%. This discount can range from 5% to 25%, making it a substantial saving opportunity.

To qualify for this benefit, proof of academic performance, like report cards or academic transcripts, is usually required. In Tennessee, most auto insurance companies provide this discount, making it accessible for many families. Besides financial savings, the good student discount serves as a motivational tool for teens to focus on their studies, linking academic success to tangible rewards. By maintaining good grades, teens learn the value of discipline and responsibility, essential traits for safe driving.

Enrolling in Safe Driving Programs

Enrolling your teen in safe driving programs is another effective avenue to reduce car insurance costs while ensuring they develop sound driving habits. Many insurance companies offer these programs, which are designed to incentivize safe and responsible driving through discounts and rewards. Programs like Nationwide's SmartRide or Progressive's Snapshot are perfect examples, offering discounts based on safe driving behaviors tracked via a mobile app or device.

These programs monitor critical behaviors such as speed, braking, and driving during high-risk hours, such as late nights. Safe driving programs can provide immediate savings—like a 10% upfront discount—and the potential for further reductions as safe driving habits are demonstrated. The feedback received from these programs is invaluable, guiding young drivers to improve and maintain safe driving practices. By committing to these programs, families not only enjoy lower premiums but also equip their teens with the tools necessary for long-term safety on the road.

Implementing Telematics Programs for Safe Driving

Telematics programs offer a modern approach to reducing car insurance costs for teenage drivers by emphasizing safe driving habits through real-time monitoring. These programs, offered by insurers like Allstate and Progressive, utilize a device or mobile app to track driving behaviors, including speeding, harsh braking, and time of day when driving occurs. The data collected can directly influence premium rates, rewarding safe driving patterns with reductions in cost.

Participation in telematics programs can potentially save policyholders up to 30% on their premiums. These programs not only provide potential financial relief but also foster educational opportunities for teens as they receive feedback on their driving. This feedback helps cultivate disciplined and safer driving habits over time. For parents, these programs offer peace of mind by allowing them to oversee their teen’s driving behavior in real-time. By endorsing telematics programs, families harness both technological advancements and financial incentives to promote safety and responsibility on the roads.

Selecting the Right Vehicle for Young Drivers

Adding a teen to your auto insurance policy in Tennessee is a significant decision that involves careful consideration of costs and coverage. Teenage drivers are categorized as high-risk, which typically leads to increasing insurance premiums when added to an existing plan. However, adding them to a parent's policy can prove more economical than purchasing a standalone policy due to the established lower rates for experienced drivers in the family. To ensure both safety and affordability, choosing the right vehicle for your teen plays a crucial role. By exploring various discounts and optimizing your auto insurance policy, families can find a balance between necessary coverage and reasonable rates.

Importance of Safety Features

Safety features in vehicles can greatly impact the cost and effectiveness of your teen's auto insurance policy. Enhanced liability limits on policies are crucial for young drivers, aiming to sufficiently cover medical and repair expenses from accidents. Teenagers benefit from the extra coverages available on a parent's policy, including services like roadside assistance and rental car reimbursement, which enhance safety and security. It's wise for parents to leverage educational resources such as the NAIC’s Insurance 101 for Teen Drivers to instill in teens the importance of safe driving practices. Selecting a suitable vehicle for your teen can also mitigate insurance costs. Sports cars, SUVs, and convertibles often attract higher premiums due to their association with riskier driving behavior. Establishing a driving contract can further help manage a teen’s driving duties and responsibilities, fostering safe driving habits and potentially easing financial liabilities related to insurance.

Choosing Affordable and Safe Models

Choosing a safe and affordable vehicle is key to managing insurance costs for teenage drivers. Cars with advanced safety features often come with lower insurance premiums because they are less likely to be involved in serious accidents. Opting for vehicles with high safety ratings not only protects young drivers but can lead to significant insurance savings. In addition, cars equipped with telematics devices can qualify your teen for discounts by assessing and promoting safe driving behavior, demonstrating responsibility to the insurance provider.

When selecting a vehicle, consider models that have low repair costs, as these expenses influence insurance premiums. Cars with lower expenses to maintain generally come with fewer claims, translating to more affordable insurance rates. Moreover, opting for cars with a strong record of reliability can avoid potential increases in insurance premiums associated with higher-risk vehicles. By prioritizing safety, reliability, and affordability in a vehicle, parents can ensure that their teens are not only safe on the road but also maintain manageable insurance costs over time.

Tips for Bundling and Multi-Car Discounts

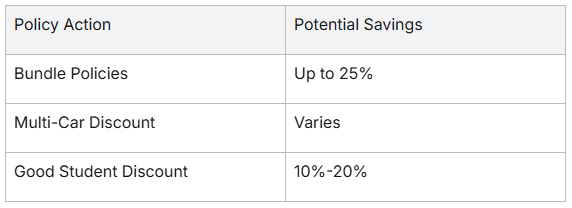

When adding a teen to your auto policy, bundling can be a strategic move to reduce insurance costs. Here are some tips for bundling and taking advantage of multi-car discounts:

Combine Policies: Consider bundling your teen's auto insurance with your existing policies.

Family Plans: Include your teen under a family auto policy rather than purchasing a separate one. This can lower the overall premium and provide a unified billing statement.

Multi-Car Discounts: If your household has multiple vehicles, you can qualify for a multi-car discount. Ensure your teen's car is included in this arrangement to save on insurance costs.

Explore Discounts: Apart from bundling, check if your teen qualifies for a good student discount or discounts by participating in telematics programs that monitor safe driving habits.

Review Coverage Options: Opt for a policy that offers adequate liability and collision coverage for your teen while benefiting from bundled savings.

Consult an Insurance Agent: Speak with an insurance agent to tailor the best bundling and discount strategy for your family's needs.

Here's a quick summary:

By strategically bundling and leveraging discounts, you can effectively manage your insurance expenses while providing quality coverage for your teen driver.

Consulting with Insurance Providers for Tailored Coverage

When adding a teen to your auto policy in Tennessee, consulting with insurance providers is crucial for tailored coverage. Different insurers have varying requirements; some may require your teen to be added to your policy as soon as they obtain their learner's permit, while others may wait until they are fully licensed. To get started, reach out to your insurance company to determine if your teen is covered under your existing policy or if a new policy is necessary.

They can assist in understanding state-mandated minimums and recommending optional protections such as personal injury protection or uninsured motorist coverage. Discussing vehicle choices with your insurer is also essential, as selecting safer vehicles can lead to lower insurance rates for your teenage driver.

Here’s a list of potential discounts to explore with your provider:

Good Student Discount

Infrequent Driving Discount

Driver’s Education Course Discount

By consulting with an insurance expert, you can ensure your teen receives the necessary protection while also managing insurance costs effectively.